Did you think that the historic rise in interest rates had taken the shine off property investment? In fact, the opposite is true. While the unprecedented rise in the cost of money over the last three years brought Belgian house prices back to their pre-covid levels (by around 10-15%, according to our estimates), providing great opportunities for investors, they can now also count on a sharp rise in rents to boost the profitability of their investment.

According to Federia, the Federation of French-speaking estate agents in Belgium, rents rose last year by 4.3% in Wallonia compared to 2022 (to an average of 793 euros, all types of accommodation combined), by 6.4% in Flanders (to 868 euros) and by 8.6% in the Brussels Region (to 1,249 euros). That's more than theinflation (+4.03% in 2023).

These increases, based on 80,000 new leases (in force), are mainly explained by:

- Fewer homes available to rent, particularly because of a number of counter-productive measures taken by regional governments (temporary freeze on rent indexation, winter moratorium, tenant's right of preference, abolition of VAT at 6% for developers' demolition/reconstruction projects, etc.)

- The long-term return of many households to the rental market following the spectacular rise in interest rates, which excluded them from the buyers’ market.

These figures contrast with the slowdown imposed by regional governments when they decided to suspend or limit existing rent indexation mechanisms (see our article on this subject). But even if these limitations had not existed, they are higher than inflation. As a reminder, inflation had fallen back to 4.06% in 2023 after a rise to 9.59% in 2022.

For 2024, the Planning Bureau has revised its forecasts downwards and is now expecting an average consumer price inflation of 3.0% in 2024 and 1.8% in 2025.

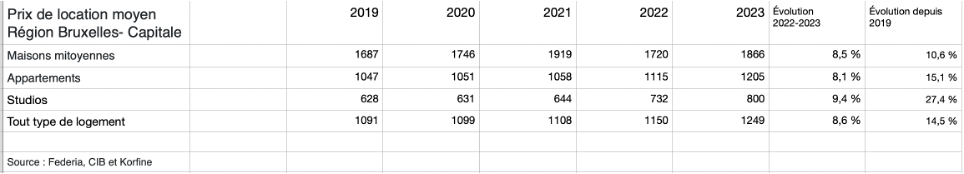

1.205 euro for a flat and 800 for a studio in Brussels

In the Brussels-Capital Region, where the median rent rose by 10.6% last year and by more than 15% in two years (to €1,100),

- Studios led the way, with an increase of 9.4% last year (to 800 euros), taking their rise over 5 years to 27.4% (see table below).

- Apartments, which make up 90% of housing available in the capital, are 8.1% more expensive than in 2022, with an average price of €1,205.

- Semi-detached houses saw an almost similar rise (+8,5%, to €1,866).

Over 5 years, we have calculated that rents in the Brussels-Capital Region have risen by 14.5% for all housing types. This is the result of two years of stabilisation (2020 and 2021, +0.8% each), an upturn in 2022 (+3.9%) and, above all, this 8.6% surge in 2023. As a result, only one in four homes in Brussels is still below 900 euro.

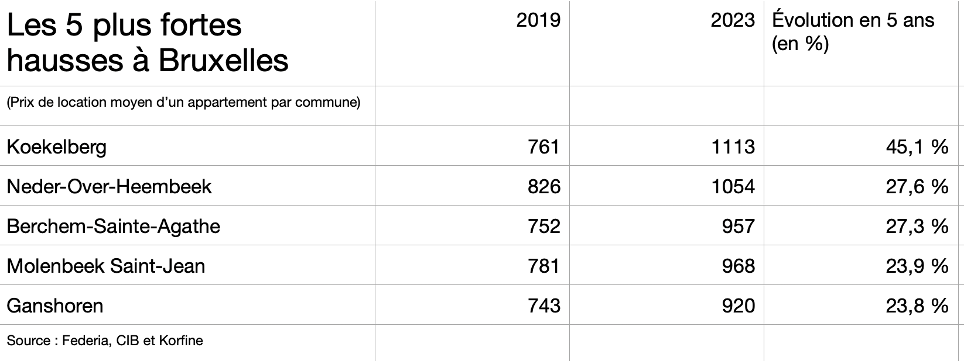

The Brussels municipalities that have seen their rents rise most sharply over the last five years are all in the north-western part of the Region (see table below).

The highest rents remain in Woluwe Saint-Pierre (average of 1,413 euros, +12.9% in 5 years), Uccle (1,376 euros, +18.1%), Ixelles (1,351 euros, +18.6%), Woluwe Saint-Lambert (1,301 euros, +22.4%) and Bruxelles-Ville (1,279 euros, +14.1%).

Only the municipality of Saint-Josse-Ten-Noode recorded a decline (-3.4%, to 925 euros), and only one municipality in three still has an average rent of less than 1,000 euros.

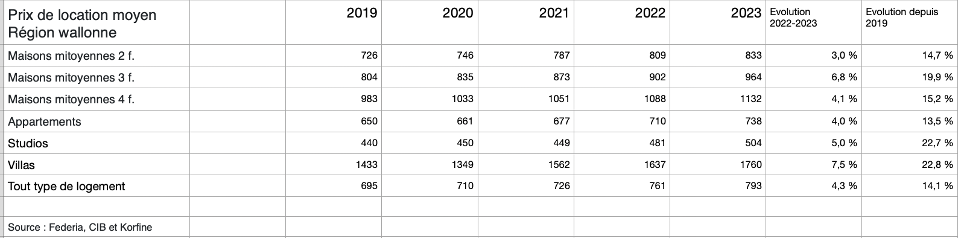

Semi-detached houses cost half as much in the Walloon Region as in Brussels

In the Walloon Region, the rise in rents is therefore less marked (+4.3%, to 793 euros for all types of housing) and lower than the increase seen in 2022 (+4.8%). This further widens the gap with the other two Regions: the rent for a semi-detached house is now two times less expensive than in Brussels.

Broken down by accommodation type (see table below), studios and villas have shown the strongest growth over 5 years (+22.7% and +22.8% respectively), while semi-detached houses have risen by an average of 16.6% and apartments by 13.5%.

- In this region too, the imbalance between supply and demand has increased sharply because of the rise in interest rates and measures which discouraged investment.

- Housing affordability has fallen by 50% in two years.

By province, it is in Walloon Brabant that rents remain, unsurprisingly, the most expensive (1,084 euros). But this is also where they recorded the strongest growth in 2023 (+6.4%). The other four Walloon provinces lag far behind, with average rents of 776 euros in the province of Luxembourg (+4.8%), 775 euros in the province of Namur (+4.3%), 742 euros in the province of Liège (+3.8%) and finally 741 euros in Hainaut (+3.9%).

In fact, Hainaut is the only province in the country where the average rent for apartments remains below 700 euros and that for semi-detached houses below 800 euros. When it comes to individual houses, only the province of Luxembourg still offers rents below 1,000 euros, compared with almost 1,500 euros in Walloon Brabant.

A (very) positive impact on yield

Based on its experience, BuyerSide currently estimates the gross yield “deed in hand” (the annual rent divided by the purchase price increased by registration duties and notary fees) at 4.5% for an investment property in a good location in Brussels and in good condition.

Theoretically, and all other things being equal, i.e. at constant purchase prices, the rise in rents should quickly raise this yield to 4.98%, based on the average rise in the 5 best-located municipalities in Brussels (+10.6%).

And even if key rates fall by 1% in 2024, as expected by the markets, and automatically increase purchase prices by 3.125% (a quarter of the fall induced by the 4% rise in rates), the ratio would remain very favourable, at around 4.8%.